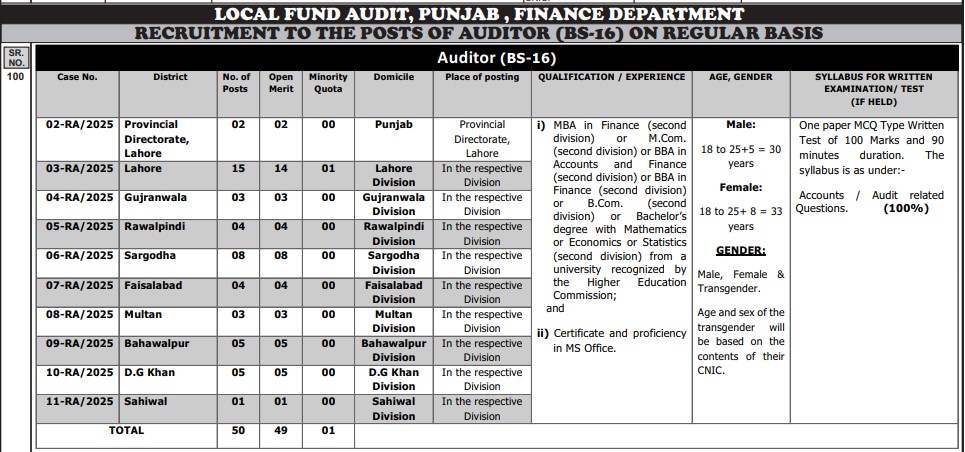

| Department | LOCAL FUND AUDIT, PUNJAB , FINANCE DEPARTMENT |

|---|---|

| Name of Posts | Auditor (BS-16) |

| Qualification | MBA in Finance (second division) or M.Com. (second division) or BBA in Accounts and Finance (second division) or BBA in Finance (second division) or B.Com. (second division) or Bachelor’s degree with Mathematics or Economics or Statistics (second division) from a university recognized by the Higher Education Commission. |

| Experience | Certificate and proficiency in MS Office. |

| Apply online | https://www.ppsc.gop.pk |

| Last Date | 03-03-2025 |

| Ad source | https://www.ppsc.gop.pk |

Role of an Auditor in Local Fund Audit, Punjab Finance Department, Pakistan – Ensuring Transparency and Accountability

The Auditor in the Local Fund Audit (LFA) within the Punjab Finance Department, Pakistan, plays a pivotal role in ensuring transparency, accountability, and efficient utilization of public funds. This position is critical for maintaining the integrity of financial operations in local government bodies, autonomous institutions, and other entities funded by the Punjab government. Below is a detailed overview of the role of an Auditor in Local Fund Audit, Punjab, and how they contribute to public financial management in Pakistan.

Key Responsibilities of an Auditor in Local Fund Audit, Punjab

1. Financial Auditing

- Conducting audits of financial statements, records, and transactions of local government bodies and autonomous institutions.

- Verifying the accuracy, completeness, and reliability of financial records to ensure compliance with Punjab Financial Rules and other regulations.

- Identifying discrepancies, irregularities, or financial mismanagement in the use of public funds.

2. Compliance Auditing

- Ensuring that all expenditures and financial operations comply with the Punjab Local Government Act and other relevant laws.

- Verifying adherence to budgetary allocations and government policies.

- Confirming that funds are used for their intended purposes and in line with approved plans.

3. Performance Auditing

- Evaluating the efficiency and effectiveness of programs, projects, and activities funded by local funds.

- Assessing whether objectives are being achieved and whether resources are being used optimally.

- Identifying areas for improvement in financial management and service delivery.

4. Detection of Fraud and Mismanagement

- Investigating suspected cases of fraud, embezzlement, or misappropriation of funds.

- Reporting financial irregularities to higher authorities for further action.

- Recommending measures to prevent future occurrences of fraud or mismanagement.

5. Reporting and Documentation

- Preparing detailed audit reports that highlight findings, observations, and recommendations.

- Submitting audit reports to the Finance Department and local government bodies.

- Ensuring that reports are clear, concise, and actionable.

6. Advisory Role

- Providing guidance and recommendations to local government bodies on improving financial management and internal controls.

- Assisting in the implementation of best practices for accounting and financial reporting.

7. Coordination and Liaison

- Collaborating with other departments, such as the Accountant General’s Office and the Auditor General of Pakistan, for a coordinated approach to auditing.

- Liaising with local government officials to address audit-related issues and queries.

8. Capacity Building

- Conducting training sessions and workshops for local government staff to enhance their understanding of financial rules and audit requirements.

- Promoting awareness about the importance of transparency and accountability in public financial management.

9. Follow-Up on Audit Recommendations

- Monitoring the implementation of audit recommendations by local government bodies.

- Conducting follow-up audits to ensure corrective actions have been taken.

10. Ensuring Public Accountability

- Upholding the principles of transparency and accountability in the use of public funds.

- Contributing to public trust by ensuring that local funds are managed responsibly